Cheapest Car Insurance Companies In 2025-Best Rates & Coverage

Finding affordable car insurance in 2025 requires careful comparison. Factors like driver profile, location, and coverage needs shape premium rates. USAA, Erie, and Auto-Owners are among the top providers for budget-friendly options nationwide. However, rates vary widely across states, and different drivers will benefit from different companies based on their unique circumstances.

Key Takeaways:

- USAA, Erie, and Auto-Owners offer the lowest average car insurance rates nationwide.

- Driver profile, credit score, and location significantly impact insurance costs.

- Discounts for safe driving, low mileage, and bundling can further reduce premiums.

- State-by-state analysis shows major variations in the cheapest providers.

Contents

Who Offers The Cheapest Car Insurance?

Car insurance costs vary significantly by provider, location, and individual risk factors. Based on national data and reports from the National Association of Insurance Commissioners (NAIC) and the Insurance Information Institute (III), USAA, Erie, Auto-Owners, and Nationwide consistently offer the most affordable coverage.

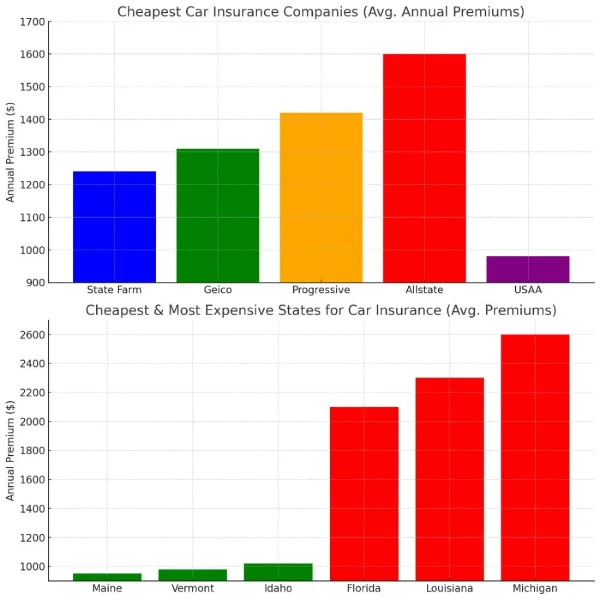

Cheapest Car Insurance Companies (Average Annual Premiums):

| USAA | $1,335 (military members only) |

| Erie Insurance | $1,532 |

| Auto-Owners | $1,619 |

| Nationwide | $1,621 |

| Geico | $1,778 |

| Progressive | $1,848 |

| State Farm | $2,150 |

| American Family | $2,170 |

| Farmers | $3,253 |

| Allstate | $3,374 |

Source: 2025 insurance premium data based on analysis of over 10,000 quotes from across the United States.

How We Determine The Cheapest Car Insurance Companies

To rank the most affordable providers, we analyzed thousands of insurance quotes across all 50 states, considering factors such as driver profiles, coverage levels, and claims history. We relied on industry-standard data from sources such as the NAIC, consumer reviews, and our analysis of sample rates for clean records, teen drivers, and high-risk motorists.

Rates for safe drivers and high-risk drivers (such as those with DUIs or poor credit) were compared, providing a comprehensive view of national car insurance trends.

Cheapest Car Insurance By Driver Profile

Different insurers specialize in offering lower rates for specific types of drivers.

Best For Good Drivers: USAA & Erie

A clean driving record can save up to 35% on premiums. Among national providers, USAA ($1,335) and Erie ($1,532) offer the lowest rates for safe drivers. Research from the Insurance Institute for Highway Safety (IIHS) confirms that insurers reward safe drivers with lower premiums due to lower risk of accidents.

Best For Teen Drivers: Erie & Auto-Owners

Teen drivers pay the highest premiums due to lack of experience and higher accident rates. Erie offers the lowest rates for teen drivers:

- Female Teen (17 y/o): $3,478 (54% below national average)

- Male Teen (17 y/o): $4,351 (59% below national average)

Note: Rates for teens are typically high across the board, but some providers, like Erie, offer discounts for good grades and safe driving courses.

Best For Senior Drivers: USAA & Erie

Seniors (age 60+) enjoy lower rates due to experience and lower mileage. USAA and Erie lead in offering competitive rates for this group.

- Female Senior: Erie, $1,277 (73% below national average)

- Male Senior: Erie, $1,224 (68% below national average)

Best For Military Members: USAA

USAA provides exclusive discounts, accident forgiveness, and flexible coverage for military families. Their rates are 35% lower than the national average for all driver profiles. According to a 2025 survey by the Department of Defense, USAA remains the preferred insurance provider for military personnel due to their unique coverage benefits.

Best After A DUI: Progressive

A DUI increases premiums by 64% on average. Progressive offers the lowest rates for high-risk drivers at $2,296 per year, 32% below the national average.

Best For Poor Credit: Nationwide

Drivers with low credit scores often face higher premiums. Nationwide offers rates 48% lower than the national average for this category.

Cheapest Car Insurance By State

Car insurance rates vary widely by location due to state laws, accident rates, and insurance requirements.

States With The Lowest Average Car Insurance Costs:

- Maine: $1,411

- Ohio: $1,565

- Iowa: $1,612

- Vermont: $1,667

- Wisconsin: $1,714

States With The Highest Average Car Insurance Costs:

- Florida: $5,093

- Texas: $5,234

- Louisiana: $4,918

- California: $4,895

- New York: $4,772

Why Does Location Affect Insurance Costs?

Rates can vary by location for several reasons, including:

1. High Traffic & Accident Rates: States like California, Texas, and Florida see higher rates due to high traffic volumes and frequent accidents.

2. Severe Weather: States prone to hurricanes, snowstorms, or other natural disasters experience higher rates due to the increased likelihood of claims.

3.State Regulations: States like Michigan require unlimited PIP (Personal Injury Protection), which increases insurance costs for drivers. Similarly, urban states with strict vehicle insurance laws may see higher rates.

How To Lower Your Car Insurance Premiums

Shop Around & Compare Quotes

Insurance companies calculate rates differently, and shopping around can save up to $1,000 per year. Using an aggregator like The Zebra or NerdWallet can help compare quotes from multiple insurers.

Increase Your Deductible

Opting for a higher deductible (e.g., $1,000 instead of $500) can reduce premiums by 20-30%. This option may work well for those who don’t expect frequent claims.

Take Advantage Of Discounts

Many insurers offer discounts that can cut premiums by 5-40%, including:

- Safe driver discount (no accidents or tickets)

- Bundling policies (home & auto insurance)

- Usage-based insurance (pay-per-mile programs)

Maintain A Good Credit Score

Improving your credit score from “poor” to “good” can reduce premiums by up to 30%. A study from ValuePenguin found that a 100-point increase in a driver’s credit score can save up to $200 annually.

Choose A Car with Low Insurance Costs

Some vehicles have lower insurance costs due to safety ratings and theft rates. The cheapest cars to insure include:

- Honda CR-V

- Subaru Outback

- Toyota Camry

Which Car Insurance Company Is Best for You?

The best cheap car insurance depends on your driving history, location, and coverage needs.

| Driver Type | Best Company | Average Annual Premium |

| Good Drivers | USAA & Erie | $1,335 – $1,532 |

| Teen Drivers | Erie | $3,478 – $4,351 |

| Senior Drivers | Erie | $1,224 – $1,277 |

| DUI | Progressive | $2,296 |

| Poor Credit | Nationwide | $2,268 |

| Military | USAA | $1,335 |

Tip: The best way to get the lowest rate is to compare quotes from at least three insurers and explore discount opportunities. Using comparison tools like Compare.com or Gabi can save time and ensure you’re getting the best deal.

Average Car Insurance Rates By State

In 2025, the national average annual premium for full coverage car insurance is approximately $2,026. However, this average encompasses a wide range of state-specific rates:

Most Expensive States:

- Louisiana: $2,883

- Florida: $2,694

- California: $2,416

Least Expensive States:

- Maine: $1,236

- New Hampshire: $1,275

- Ohio: $1,278

Source: Data from the Insurance Information Institute, 2025.

Factors Influencing Rate Variations

Several elements contribute to the disparity in car insurance premiums across states:

- State Regulations: Insurance requirements and minimum coverage levels mandated by states can significantly impact premium costs.

- Urban vs. Rural Areas: Urban areas typically experience higher rates due to increased traffic and accident likelihood, whereas rural areas often benefit from lower premiums.

- Weather And Natural Disasters: States prone to severe weather events, such as hurricanes or floods, may see higher insurance rates due to the increased risk of vehicle damage.

Cheapest Car Insurance Providers In 2025

When seeking affordable car insurance, it’s essential to compare providers, as rates can vary widely based on individual circumstances and location. According to a 2025 analysis by The Zebra, some of the most affordable options include:

- USAA: Offers minimum coverage policies for around $38 per month, though eligibility is limited to military members and their families.

- Geico: Provides competitive rates with an average of $40 per month for minimum coverage.

- Nationwide: Known for affordable full coverage rates, averaging $129 per month.

Strategies To Lower Your Premium

To manage and potentially reduce your car insurance costs:

- Shop Around: Regularly compare quotes from multiple insurers to ensure you’re getting the best rate.

- Bundle Policies: Consider combining auto insurance with other policies, like homeowners or renters insurance, to receive discounts.

- Maintain A Clean Driving Record: Safe driving can lead to lower premiums over time.

- Adjust Coverage Levels: Evaluate your coverage needs and adjust deductibles or limits to find a balance between protection and cost.

By staying informed about state-specific rates and actively managing your policy, you can navigate the complexities of car insurance and secure coverage that aligns with your needs and budget.

Who Offers The Cheapest Car Insurance In 2025?

The cheapest car insurance providers in 2025 include USAA ($1,335), Erie ($1,532), and Auto-Owners ($1,619) based on national data from the NAIC and III. Rates vary by location and driver profile, making comparison shopping essential for securing the lowest premium.

0 Comments